About Estate Planning Attorney

About Estate Planning Attorney

Blog Article

The 2-Minute Rule for Estate Planning Attorney

Table of ContentsOur Estate Planning Attorney Diaries10 Easy Facts About Estate Planning Attorney ExplainedThe Main Principles Of Estate Planning Attorney The Ultimate Guide To Estate Planning Attorney

Your attorney will likewise help you make your records authorities, setting up for witnesses and notary public trademarks as required, so you don't need to stress over attempting to do that last step on your very own - Estate Planning Attorney. Last, yet not least, there is useful assurance in establishing a relationship with an estate preparation lawyer that can be there for you in the futureJust placed, estate preparation lawyers provide value in numerous means, much beyond just offering you with published wills, trust funds, or various other estate intending documents. If you have concerns concerning the procedure and desire to discover more, contact our office today.

An estate planning lawyer aids you define end-of-life decisions and legal files. They can establish wills, establish trust funds, produce healthcare instructions, develop power of lawyer, produce sequence plans, and more, according to your wishes. Dealing with an estate preparation attorney to complete and manage this lawful documentation can aid you in the complying with eight areas: Estate intending lawyers are specialists in your state's count on, probate, and tax obligation legislations.

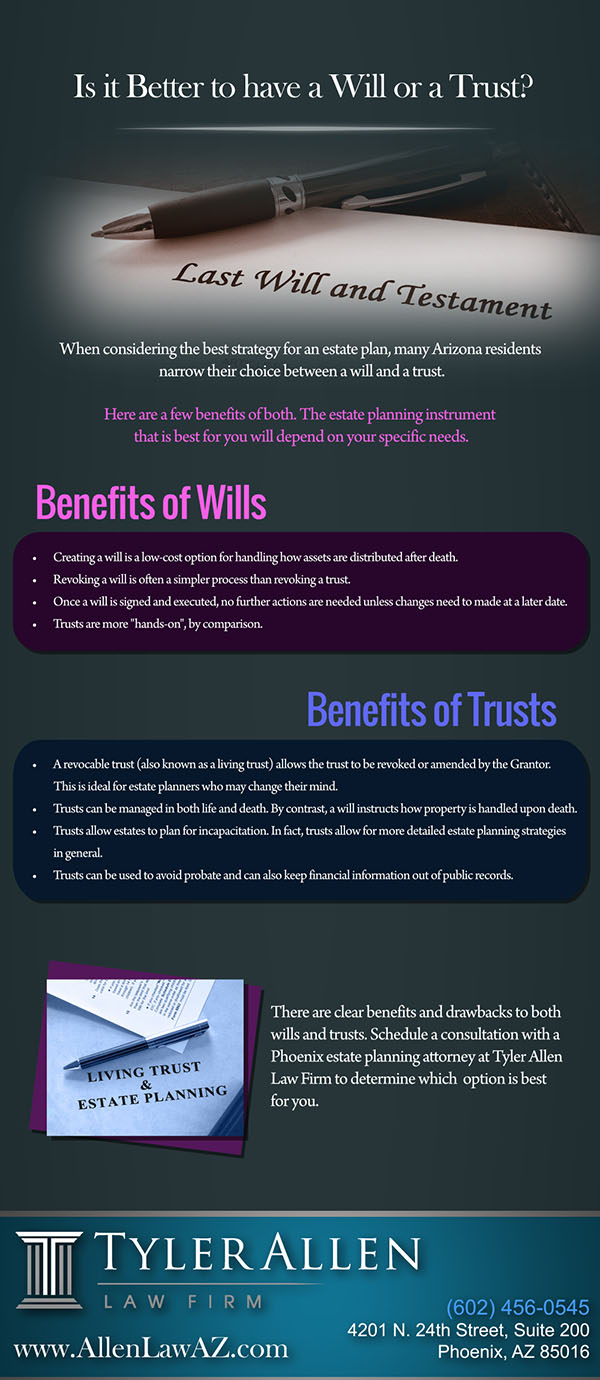

If you don't have a will, the state can make a decision exactly how to divide your possessions among your successors, which could not be according to your dreams. An estate preparation attorney can help arrange all your lawful papers and distribute your assets as you desire, potentially staying clear of probate. Many individuals compose estate preparation papers and after that ignore them.

Our Estate Planning Attorney Statements

When a customer passes away, an estate plan would certainly determine the dispersal of properties per the deceased's directions. Estate Planning Attorney. Without an estate strategy, these choices might be entrusted to the near relative or the state. Obligations of estate organizers consist of: Creating a last will and testimony Establishing trust accounts Calling an executor and power of attorneys Recognizing all beneficiaries Naming a guardian for minor kids Paying all debts and minimizing all tax obligations and legal charges Crafting guidelines for passing your worths Establishing preferences for funeral arrangements Finalizing instructions for treatment if you come to be ill and are unable to choose Obtaining life insurance policy, handicap income insurance coverage, and long-lasting treatment insurance coverage A great estate plan need to be updated regularly as clients' financial scenarios, individual inspirations, and government and state laws all evolve

Similar to any profession, there are qualities and visit the site abilities that can assist you accomplish these objectives as you work with your clients in an estate planner role. An estate planning career can be best for you if you possess the adhering to traits: Being an estate coordinator means thinking in the lengthy term.

The Ultimate Guide To Estate Planning Attorney

You need to assist your client expect his or her end of life and what will certainly take place postmortem, while at the same time not house on somber thoughts or feelings. Some customers may become bitter or distraught when contemplating fatality and it might fall to you to aid them with it.

In the event of death, you may be expected to have various conversations and ventures with enduring relative about the estate strategy. In order to succeed as an estate coordinator, you might need to stroll a great line of being a shoulder to lean on and the private relied on to communicate estate preparation issues in a prompt and specialist fashion.

Expect that it has been modified even more since then. Depending on your client's monetary earnings brace, which may evolve toward end-of-life, you as an estate coordinator will certainly find out here now have to keep your customer's possessions in complete legal conformity with any regional, federal, or global tax laws.

All about Estate Planning Attorney

Gaining this accreditation from organizations like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Belonging to these professional teams can confirm your abilities, making you extra eye-catching in the eyes of a possible client. In addition to the emotional reward of helping customers with end-of-life planning, estate coordinators appreciate the advantages of a stable revenue.

Estate preparation is a smart point to do no matter of your existing wellness and monetary condition. Nonetheless, not many people understand where to start the procedure. The first important point is to employ an estate planning attorney to aid you with it. The complying with are 5 advantages of collaborating with an estate preparation lawyer.

The portion of individuals that don't understand how to obtain a will has actually increased from 4% to 7.6% since 2017. A skilled lawyer understands what info to consist of in the will, including your beneficiaries and special considerations. A will certainly protects your family members from loss as a result of immaturity or disqualification. It likewise gives the swiftest and most effective method to move your possessions to your recipients.

Report this page